Table of Content

In some cases, the fees can be high enough to cancel out the savings of a low rate. Lending has become increasingly more costly for homeowners and borrowers alike as mortgage rates continue to rise. Mortgage rates jumped 1.5 percentage points during the first three months of the year, the biggest quarterly climb in 28 years.

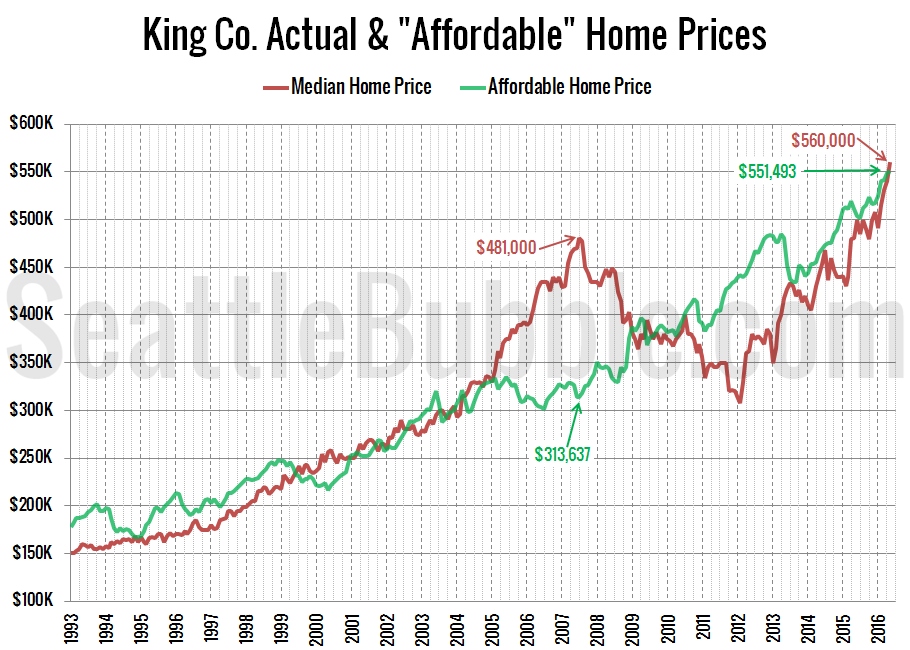

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. And of course, if you have a larger down payment, it will help you in all these factors for affording a home. As home values rise, so do insurance premiums and property taxes. Homeownership provides the certainty of knowing where you’ll live from one year to the next.

Call 1-866-290-0462 or find a mortgage consultant in your area

Mortgage lenders come in all shapes and sizes, from online companies to brick-and-mortar banks — and some are a mix of both. Decide what type of service and access you want from a lender and balance that with how competitive their rates are. You might decide that getting the lowest rate is the most important factor for you, while others might go with a slightly higher rate because they can apply in person, for example. Some banks offer discounts to existing customers, so you might be able to save money by getting a loan where your savings account or checking account is.

Editorial content from NextAdvisor is separate from TIME editorial content and is created by a different team of writers and editors. The slower housing market has also caused competition for homes to plummet, meaning buyers have more room to negotiate and are less likely to get into bidding wars. That can be an opportunity for those who can manage the higher cost of a mortgage. Mortgage rates aren’t expected to drop back to the levels where they started the year and sat throughout 2021 – around 3% – but should fall back to around 5% or 6%, experts say. That could help rejuvenate a housing market that slowed to a crawl in the fall of 2022. The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, and rates have so far risen beyond 7 percent in 2022.

FAQs about mortgage interest rates

Our site has comprehensive free listings and information for a variety of financial services from mortgages to banking to insurance, but we don’t include every product in the marketplace. In addition, though we strive to make our listings as current as possible, check with the individual providers for the latest information. Under the festive offer, the bank is currently offering a concession from 15 bps to 30 bps in various home loan categories. The steady decline in mortgage rates has helped kickstart mortgage demand, according to Freddie Mac Chief Economist Sam Khater. Mortgage applications increased 3.2% last week from the week prior, according to the Mortgage Bankers Association's seasonally adjusted index. Sure, this means Wall Street, but non-market forces can also influence mortgage rates.

A month ago, the average rate on a 30-year fixed refinance was higher, at 6.86 percent. At the current average rate, you'll pay principal and interest of $638.66 for every $100k you borrow. The average rate you'll pay for a 30-year fixed mortgage is 6.60 percent, up 8 basis points over the last seven days. This time a month ago, the average rate on a 30-year fixed mortgage was higher, at 6.87 percent. The central bank raised rates again at its November meeting — but what comes next is a toss-up.

Consider different types of home loans

We are an independent, advertising-supported comparison service. Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their “forever home” have less to fear if the market reverses as they can ride the wave of ups and downs.

Monthly payments on a 5/1 ARM at 5.46 percent would cost about $565 for each $100,000 borrowed over the initial five years, but could increase by hundreds of dollars afterward, depending on the loan's terms. The average 15-year fixed-mortgage rate is 6.00 percent, up 9 basis points over the last seven days. The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories.

How to read our rates

It can make sense for buyers with more disposable cash, but if high closing costs will prevent you from securing your loan, buying points might not be the right move. A mortgage preapproval is a statement from a lender indicating it’s prepared to help you finance a home purchase for a specific amount. The lender issues the preapproval only after deeming you’re eligible based on a review of your credit and finances. Jumbo mortgages are loans that exceed federal loan limits for conforming loan amounts. For 2022, the maximum conforming loan limit for single-family homes in most of the U.S. is $647,200, and $970,800 in more expensive locales. Jumbo loans are more common in higher-cost areas and generally require more in-depth documentation to qualify.

An ARM is ideal for households who will refinance or sell before the rate changes. If that’s not the case, their interest rates could end up being remarkably higher after a rate adjusts. A 5/1 ARM has an average rate of 5.46%, a slide of 2 basis points from the same time last week. The median rate for a 15-year fixed mortgage is 5.99%, which is a decrease of 2 basis points compared to a week ago. The average 30-year fixed mortgage interest rate is 6.60%, which is a decrease of 3 basis points from last week.

However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders. Treasury bond yields, rising inflation and the Federal Reserve’s monetary policy indirectly influence mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates. Using the lender your real estate agent typically works with doesn't guarantee you'll get the best mortgage rate for your home loan. Ask around for recommendations or use an online tool to find a lender who can provide you with a loan that is best for your situation. With a fixed-rate mortgage, you know your principal and interest costs won’t change.

Conforming Fixed-Rate Loans - APR calculation assumes a $464,000 loan with a 25% down payment and borrower-paid finance charges of 0.862% of the loan amount, plus origination fees, if applicable. Conforming rates are for loan amounts not exceeding $647,200 ($970,000 in AK and HI). A fixed-rate mortgage has an interest rate that doesn’t change throughout the life of the loan. Of course, if rates fall, you’ll be stuck with your higher rate unless you refinance. There are many types of fixed-rate mortgages, such as 15-year fixed-rate, jumbo fixed-rate and 30-year fixed-rate mortgages.

It's a good idea to lock the rate when you're approved for a mortgage with an interest rate that you're comfortable with. Consult with your loan officer on the timing of the rate lock. Ideally, your rate lock would extend a few days after the expected closing date, so you'll get the agreed-upon rate even if the closing is delayed a few days. Lenders will have a base rate that takes the big stuff into account and gives them some profit.

But buyers who plan on moving in a few years are in a riskier position if the market plummets. That’s why it’s so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice. To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros. For others, it could mean downsizing, or foregoing amenities or important contingencies like a home inspection.